Creating and Configuring Contract Components

Last updated on 2025-01-02

Overview

Contract components are individual elements of a lease contract. Each component enables the precise recording and management of different lease terms, conditions and properties of individual underlying assets within the same lease contract.

This modular approach to recording components offers a high degree of flexibility in accounting for your leases and takes into account the complexity of modern lease contracts.

You can create and configure contract components in the Contract components workspace. You can also modify contract components that have already been calculated.

Lucanet Lease Accounting can only be used for accounting of regular leases in accordance with IFRS 16.3-4. Short-term and low-value leases are therefore not included in the calculation.

As such, we recommend only using this software to record leases that are categorized as regular per IFRS 16.3-4.

This article contains the following sections:

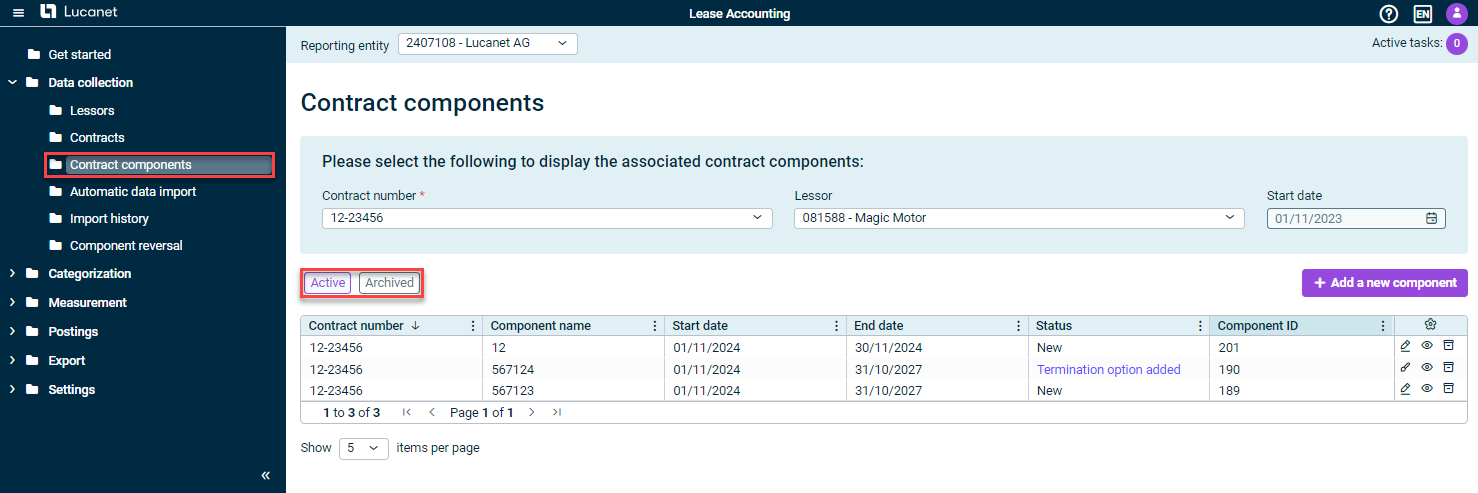

'Contract Components' Workspace

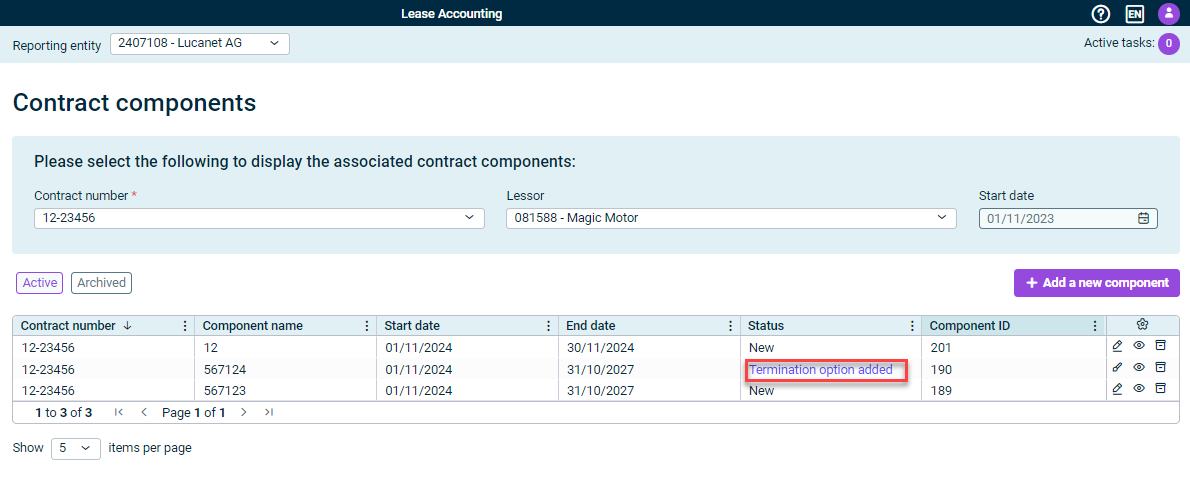

In the Contract components workspace, you can display all components that have already been created for a contract.

- Select the corresponding contract number. To restrict the selection of contract numbers to one lessor, you can first select the corresponding lessor.

- Use the Active and Archived buttons if you only want to see active or archived components:

Creating Contract Components

To create a new component for a contract, select the contract number in the upper area and click Add a new component.

In the displayed New contract component dialog, configure the options as described in the next chapter.

Configuring Contract Components

When configuring a contract component, the following options are available:

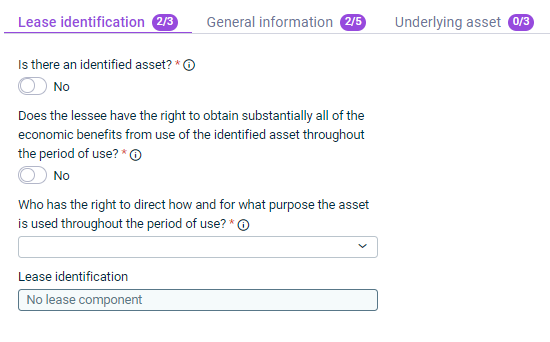

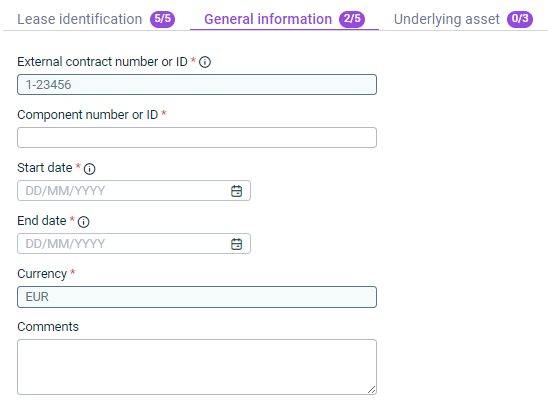

- Fields marked with a * are mandatory fields. The number of mandatory fields on each tab and how many have already been filled in is displayed next to the name of the tab:

- Fields that have been grayed out cannot be edited. They are filled in automatically based on the information in Lease Accounting.

Option

Description

Is there an identified asset?

Specify whether the contract component is an asset that is identified in accordance with IFRS 16.3-4.

Does the lessee have the right to obtain substantially all of the economic benefits from use of the identified asset throughout the period of use?

Specify whether the lessee derives substantially all of the economic benefit of the asset during its useful life.

Economic benefits can be fixed, consumption-independent payments, such as fixed basic rents.

Who has the right to direct how and for what purpose the asset is used throughout the period of use?

Specify whether the lessee (CUSTOMER), the lessor (SUPPLIER), or neither party (NEITHER) makes the decisions about the nature and purpose of the use of the asset.

If you select NEITHER, use the additional questions to specify whether:

- The lessee has the right to operate the asset throughout the period of use, without the lessor having the right to change those operating instructions.

- The lessee designed the asset in a way that predetermines how and for what purpose the asset will be used throughout the period of use?

In some cases the relevant decisions about how and for what purpose the asset is used are predetermined. For example, the lessee has the right to direct how and for what purpose the asset is used if he

- is able to transform a building originally used for administrative purposes into a production building.

- is able to use a vehicle originally used in Germany autonomously in a foreign country.

- decides about the produced parts.

Lease identification

Based on the information you enter on this tab, this is where the system automatically displays whether the component is identified as a leasing component.

If the component is identified here as a non-lease component, you can cancel the recording of the components, as the component does not then have to be accounted for in accordance with IFRS 16.

‘General Information’ Tab

‘General Information’ Tab

Option

Description

External contract number or ID

Displays the number of the contract to which you have assigned the component.

Component number or ID

Identification number for the component

Start date

Start date of utilization of the related component

End date

End date of utilization of the related component without considering extension and/or termination options

Currency

Displays the functional currency recorded in Lease Accounting for the selected reporting entity (lessee).

Comments

Optional comments on the details configured on this tab

Option

Description

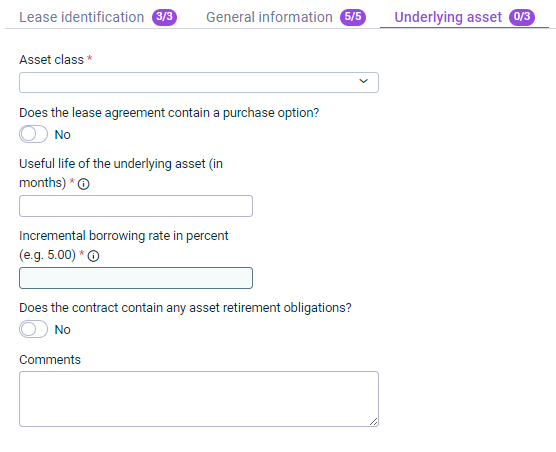

Asset class

Asset class of the component

Useful life of the underlying asset (in months)

Period during which an asset is available for use by the company

Incremental borrowing rate in percent (e.g. 5.00)

Incremental borrowing rate for the lease

This field is filled automatically based on the interest rate configured for the selected asset class and cannot be edited.

The lease liability is measured on initial recognition at the present value of future lease payments. For this, the future lease payments are discounted with the incremental borrowing rate of the reporting entity. The incremental borrowing rate is the interest rate that the reporting entity would have agreed to inception date of the lease, if it had to borrow funds for the same period for the purchase of the leased property.

Does the contract contain any asset retirement obligations?

Specify whether the contract contains any asset retirement obligations.

If so, also state the present value of the amount of the obligation (in component currency).

Comments

Optional comments on the details configured on this tab

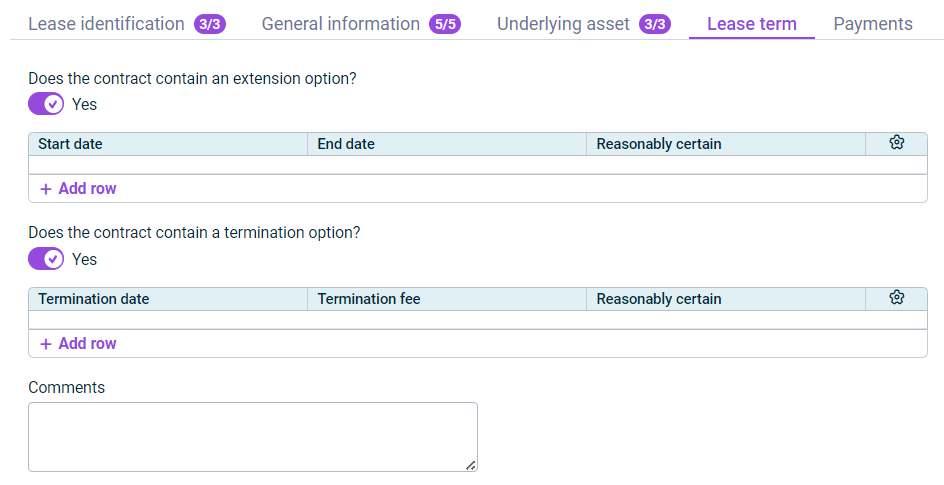

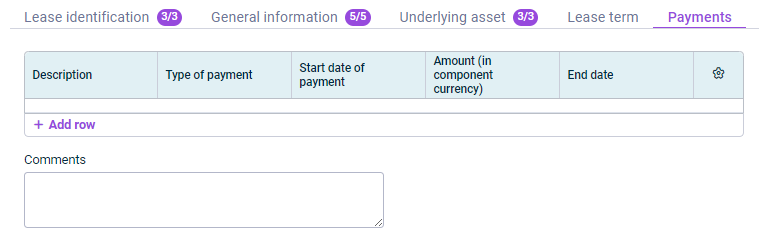

Option

Description

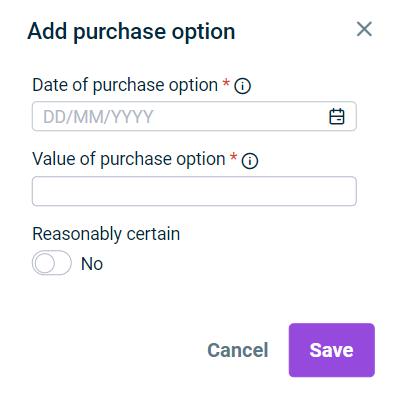

Does the contract contain an extension option?

Specify whether an extension option has been agreed for the component.

If Yes, configure the details of the extension option(s) by clicking Add row in the table that appears and specifying the following:

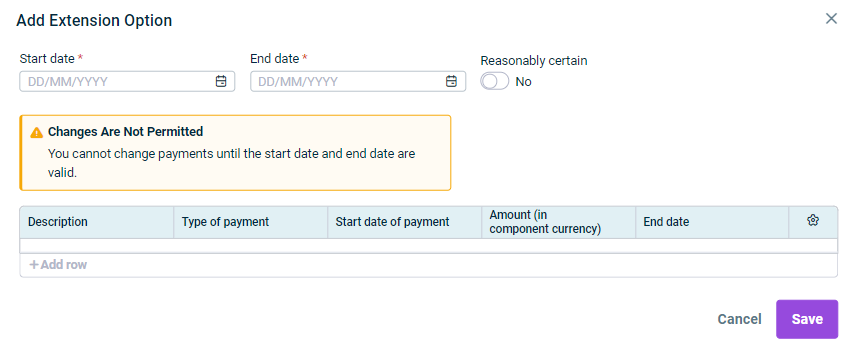

'Add extension option' dialog

'Add extension option' dialog

- Start and end date of the extension option(s)

- Whether the exercise of the extension option is reasonably certain

- The following payment details for each individual extension option that was created by adding a row:

For single payments for an extension option

For regular payments for an extension option

A detailed description of the individual fields that are configured in the Create payment dialog can be found in the description of the Payments tab.

Comments

Optional comments on the details configured on this tab

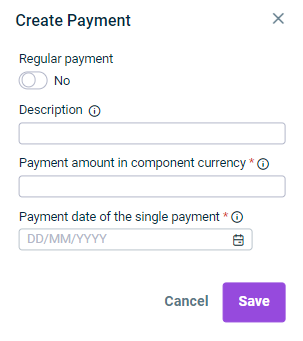

For single payments

Option

Description

Regular payment

Specifies whether the payment is a regular payment or a single payment.

For a single payment, choose No.

Description

Description for the payment.

Examples for real estate: basic rent; prepayment operating expenses; rent for 1st floor, etc.

Payment amount in component currency

Amount entered in the contract for the payment (in component currency)

Payment date of the single payment

Time agreed for the single payment

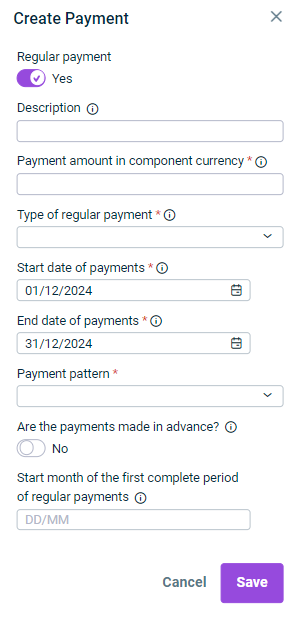

For regular payments

Option

Description

Regular payment

Specifies whether the payment is a regular payment or a single payment.

For a regular payment, choose Yes.

Description

Description for the payment.

Examples for real estate: basic rent; prepayment operating expenses; rent for 1st floor, etc.

Payment amount in component currency

Amount entered in the contract for the payment (in component currency)

Type of regular payment

Specifies whether the payment is a fixed payment or a variable payment.

Start and end dates of payments

First and last dates of the payments

The start and end dates of the payments define the interval for a series of payments in Lease Accounting in order to represent contract-specific payment terms. The start and end dates of payments may differ from the start and end of the contract.

Payment pattern

Choose whether payment is made yearly, half-yearly, quarterly, or monthly.

Are the payments made in advance?

Specifies whether the payments are in advance, i.e. that the payments must be made at the beginning of the period.

Start month of the first complete period of regular payments

Month in which the first full regular payment is made (in format MM-DD)

Examples:

- Calendar month payments in arrears

- Start of component term: 13 March 2022

I.e. the first full payment for a whole calendar month takes place in April. The start date of the first full period of regular payments is therefore (MM-TT): 04-01

If terms of payment cause regular payments to be scheduled at dates outside the defined component term, please set up those specific payments as single payments using the respective part of the payment dialog. The Lease Accounting validation will not consider regular payments scheduled for dates outside the defined component term.

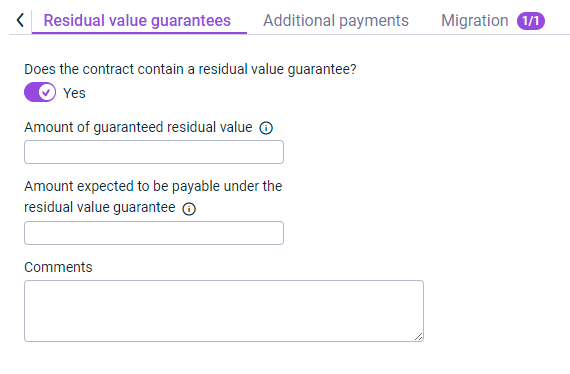

Option

Description

Does the contract contain a residual value guarantee?

Specify whether a residual value guarantee has been agreed for the component.

If Yes, configure the details of the residual value guarantee by entering the following in the displayed fields:

- Amount of guaranteed residual value

- Amount expected to be payable under the residual value guarantee

Comments

Optional comments on the details configured on this tab

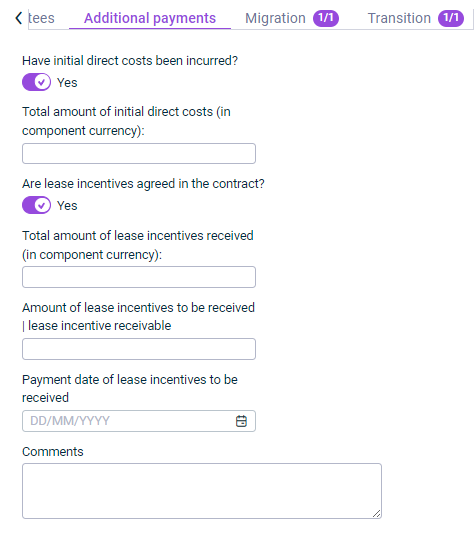

Option

Description

Have initial direct costs been incurred?

Specify whether initial direct costs have been incurred.

If Yes, also specify the Total amount of initial direct costs: (in component currency).

Are lease incentives agreed in the contract?

Indicate whether incentive payments by the lessor have been agreed in the contract.

If yes, specify the following:

- The Total amount of lease incentives received (in component currency)

- The Amount of lease incentives to be received | lease incentive receivable

- The Payment date of lease incentives to be received

Comments

Optional comments on the details configured on this tab

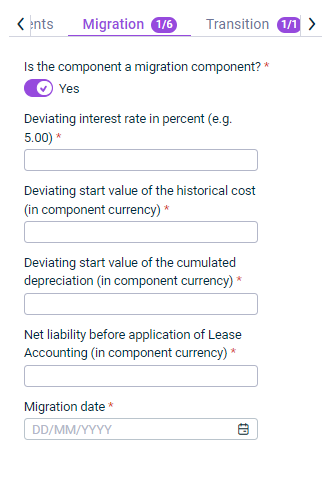

Option

Description

Is the component a migration component?

Specify whether this is a component that has already been accounted for in accordance with IFRS 16 and is now being migrated to Lucanet Lease Accounting.

If Yes, also specify the following details that will change when migrating to Lucanet Lease Accounting:

- Deviating interest rate in percent

- Deviating start value of the historical cost (in component currency)

- Deviating start value of the cumulated depreciation (in component currency)

- Net liability before application of Lease Accounting (in component currency)

- Migration date

Comments

Optional comments on the details configured on this tab

Option

Description

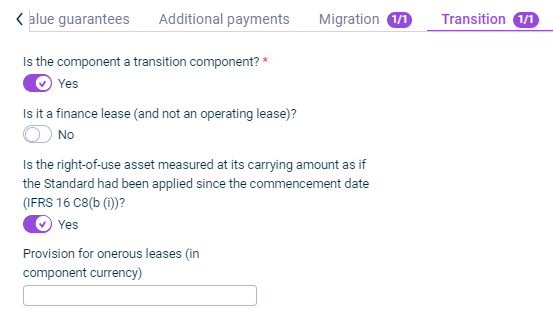

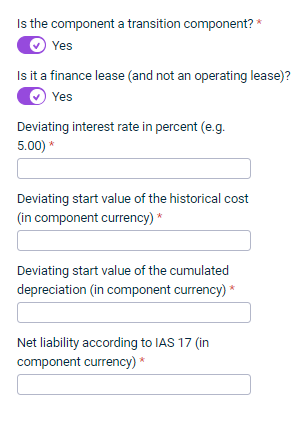

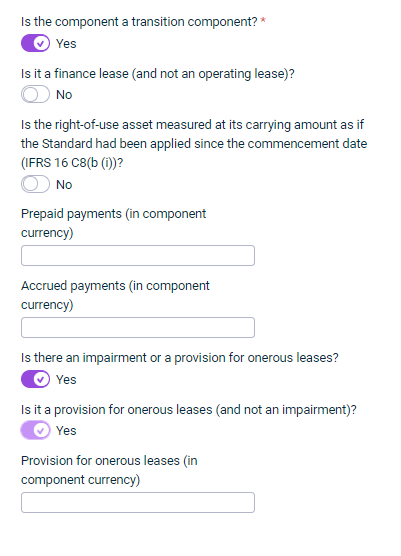

Is the component a transition component?

Specify whether this is a transition component, i.e. a component for which IFRS 16 is being applied for the first time.

If Yes, also differentiate between:

- Whether it is an operating lease or a finance lease

- Whether it is a provision for onerous leases or an impairment

Then configure the fields that are displayed based on the selection made.

Example configurations

Finance Lease

Operating lease with provision for onerous leases

Comments

Optional comments on the details configured on this tab

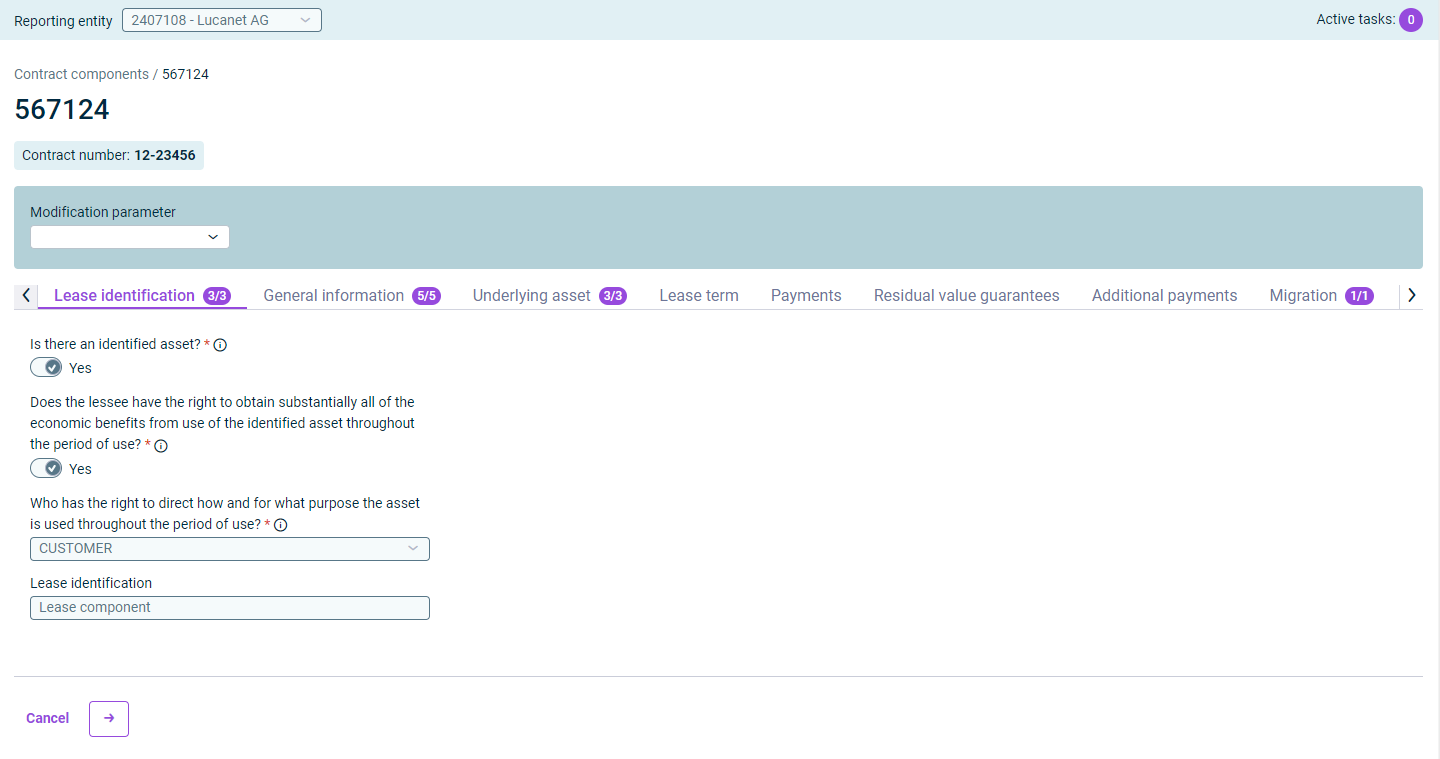

Modifying Contract Components

Components that have not yet been calculated can be edited by clicking the pencil icon  and editing the tabs as described above under Configuring Contract Components.

and editing the tabs as described above under Configuring Contract Components.

If components have already been calculated, the fields of the tabs cannot be edited. Instead, the components must be modified as described below.

To modify a contract component that has already been calculated:

- In the overview table, click the brush icon

in the row of the desired component. The detail view of the components is displayed as follows, for example:

in the row of the desired component. The detail view of the components is displayed as follows, for example:

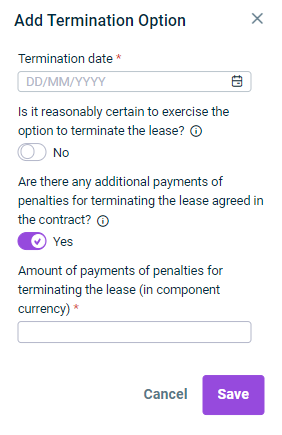

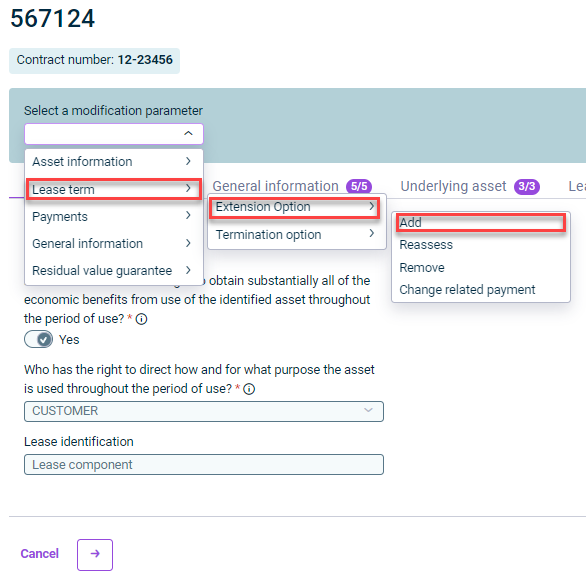

Modify component - Open the modification parameters and select the change you want to implement by navigating through the displayed drop-down menu. For example, to add an extension option, select Lease Term | Extension Option | Add:

Add extension option - Configure the data in the displayed configuration dialog. (A description of the required information can be found in the previous Configuring Contract Component section.)

- In each configuration dialog, specify the effective date from which the modification is to be included in the calculation.

- Click Save.

The last modification made is displayed in the overview table in the Status column:

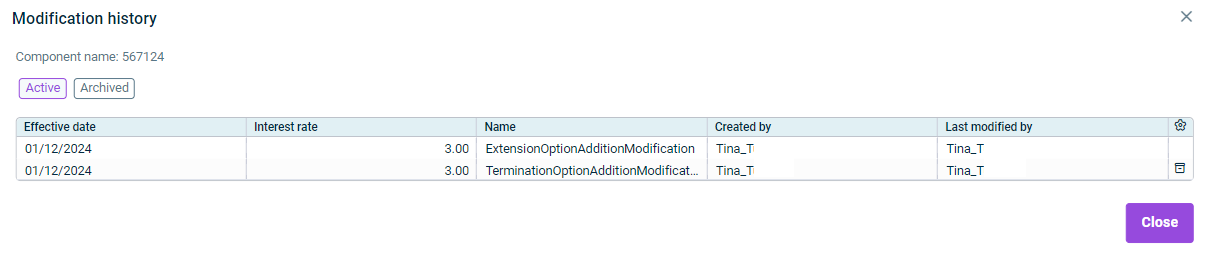

Modified component - If applicable, click the modification in the Status column to display the modification history of the component:

Modification history of a component

Modification history of a component

For a modified component to be taken into account in postings, you must calculate and save the components as described under Measuring Data.